The world of Bitcoin is buzzing with excitement and uncertainty as prices fluctuate wildly, dropping from their recent peak of over $73,000 in March. Analysts are diving deep into historical data to glean insights as selling pressure mounts, leaving some investors on edge about potential short-term losses. This historical analysis is crucial in determining whether we’re at a market top or simply experiencing a momentary pause before the trend picks up again.

What Will Determine the Depth of This Correction?

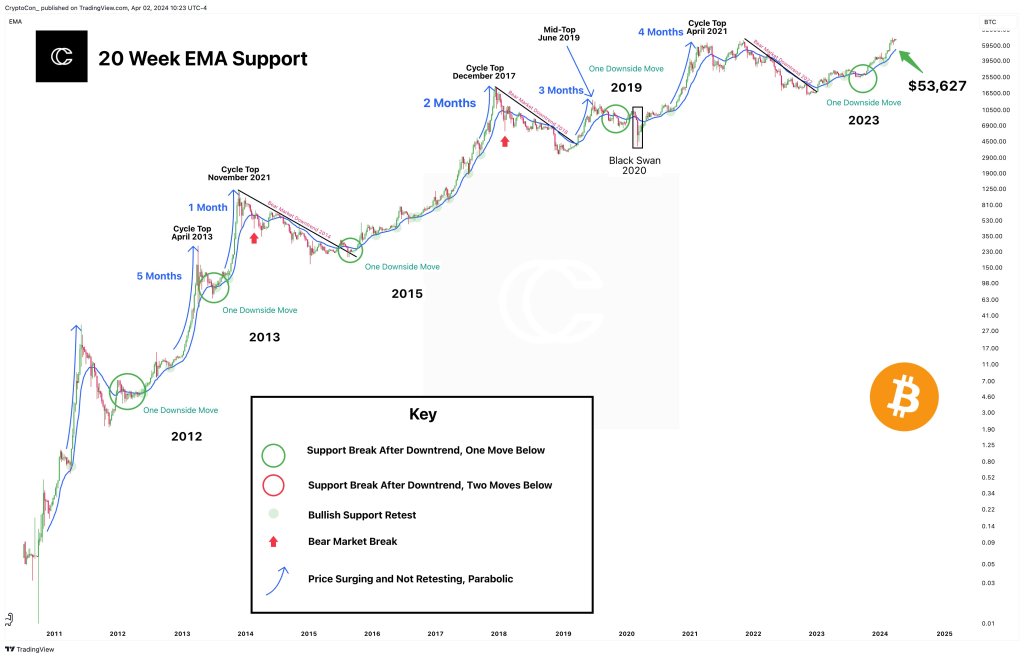

According to one analyst on X, the depth of the current correction hinges on whether Bitcoin is in a “parabolic” phase. When an asset exhibits “parabolic” prices, it means its value has surged rapidly, leading some analysts to believe that it’s unsustainable in the long run.

If this is the case, prices typically cool off after surpassing key resistance levels and all-time highs. The current cooling off period could indicate the formation of a potential “first cycle top” at March 2024’s all-time high of $73,800, resembling patterns seen in April 2013 and 2021.

On the other hand, if recent price growth hasn’t been unsustainable or parabolic, traders should anticipate a different scenario with Bitcoin likely to continue dropping and revisiting established support levels. The analyst forecasts a potential correction down to the $53,600 support in the upcoming sessions, forming a smoother curve akin to 2016-2017.

The Impact of Bitcoin Halving

Adding to the mix, another analyst is considering the Bitcoin pre-halving cycle. Typically, prices tend to plummet leading up to the halving event, scheduled for the third week of April, based on historical trends.

With Bitcoin facing continued pressure, further losses are likely in the days ahead. The daily chart indicates a downward trend below the middle BB, encountering significant resistance around the $71,700 range.

While the uptrend persists, buyers will need prices to rally and reverse losses, ideally accompanied by increased participation levels, to regain control.

Feature image from DALLE, chart from TradingView

Disclaimer: This article is for educational purposes only and does not reflect the views of NewsBTC on investment decisions. Investing carries risks, so conduct thorough research before making any financial moves. Use the presented information at your own discretion.