Exciting news in the cryptocurrency world! Tether, a key player in the market known for its popular USDT stablecoin, has just unveiled its audit statement for the first quarter of 2024. Conducted by independent accounting firm BDO, the report reveals some fascinating insights into Tether’s financial performance and growth.

The latest report goes beyond just the reserves backing Tether’s stablecoins and showcases the company’s impressive profit of $4.52 billion for the first quarter, fueled by a surge in market capital.

Discover Tether’s Soaring Financials in Q1 2024

Breaking down the numbers, Tether saw tremendous success in the first quarter of 2024, boasting a net profit of $4.52 billion. The primary contributors to this profit were entities issuing stablecoins and managing reserves, with a significant portion coming from US Treasury holdings and gains from Bitcoin and gold positions.

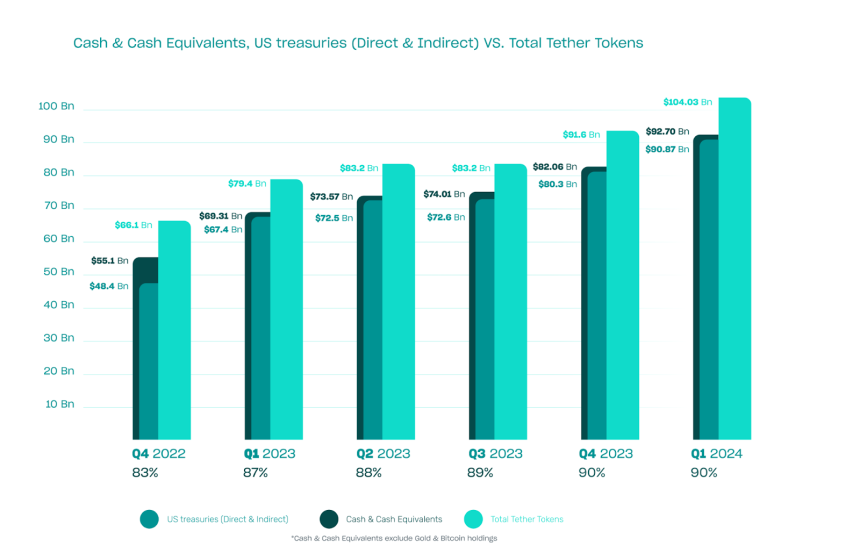

Additionally, Tether’s report revealed a substantial increase in both direct and indirect holdings of US Treasuries, surpassing $90 billion. This includes exposure through overnight reverse repurchase agreements and investments in US Treasuries through money market funds.

In a remarkable growth milestone, Tether revealed a net equity of $11.37 billion as of March 31, 2024, up from $7.01 billion reported in December 31, 2023. The company also disclosed a $1 billion increase in excess reserves, strengthening its stablecoin offerings and bringing the total to nearly $6.3 billion.

CEO Highlights Transparency And Stability

The audit confirmed that Tether-issued tokens are 90% backed by cash and cash equivalents, emphasizing the company’s commitment to liquidity within the stablecoin ecosystem. Over $12.5 billion worth of USDT was issued in the first quarter alone.

Furthermore, Tether Group’s strategic investments, exceeding $5 billion, span across various sectors like artificial intelligence, renewable energy, person-to-person communication, and Bitcoin Mining.

Paolo Ardoino, Tether’s CEO, emphasized the company’s dedication to transparency, stability, liquidity, and responsible risk management. He praised Tether’s record-breaking profits and its efforts to enhance transparency and trust in the cryptocurrency industry.

“In reporting not just the composition of our reserves, but now the Group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust.”

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell, or hold any investments and naturally investing carries risks. You are advised to conduct your research before making any investment decisions. Use information provided on this website entirely at your own risk.