Excitement is brewing in the world of Bitcoin as the cryptocurrency hovers around the $70,000 mark, with investors eagerly anticipating a continued price surge. Much of this upward momentum can be attributed to the significant accumulation by large whales, as revealed by on-chain data.

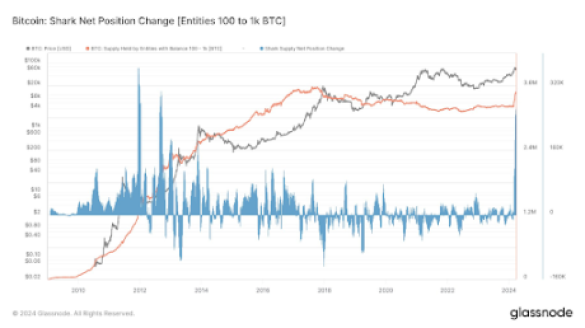

Bitcoin is no stranger to whale addresses holding vast sums of money and making market-moving transactions. However, recent data shows that this accumulation trend has extended to a new group of traders known as “Sharks,” whose wallet addresses hold between 100 BTC and 1,000 BTC. According to Glassnode, shark investors have amassed an impressive 268,441 BTC in the past month, marking the largest net position change since 2012.

Unlocking the Potential of Bitcoin Accumulation

A chart shared on social media by crypto analyst James Van Straten illustrates a significant spike in Bitcoin accumulation by shark investors in 2024, reversing a multi-year consolidation trend since 2020. This surge added 268,441 BTC to their holdings, equivalent to approximately $18 billion.

While sharks may not wield as much individual influence as whales, their collective actions paint a compelling picture of market sentiment. The ongoing accumulation trend could pave the way for increased buying activity, potentially fueling a sustained price surge for Bitcoin.

Source: Glassnode

The surge in accumulation comes in the wake of the launch of Spot Bitcoin ETFs in the US, triggering a wave of optimism among all levels of Bitcoin investors. Analysts suggest that this uptick in shark accumulation could be linked to ETFs acquiring significant amounts of Bitcoin from Coinbase OTC desks.

Not to be outdone, Bitcoin whales holding over 1,000 BTC have also ramped up their activity, positioning themselves strategically in the market. Whale Alerts have highlighted several notable transactions involving large BTC movements.

Data from IntoTheBlock corroborates this accumulation trend, showing a net outflow of $16.18 billion from exchanges compared to a $15.76 billion inflow over the past week. While Bitcoin currently trades at $67,931, the collective actions of whales, sharks, and institutional investors through Spot Bitcoin ETFs, coupled with the upcoming halving event, point towards a promising future with a potential price appreciation to $100,000.

BTC price at $70,000 | Source: BTCUSDT on Tradingview.com

Featured image from BBC, chart from Tradingview.com

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions. Trading cryptocurrencies carries inherent risks.