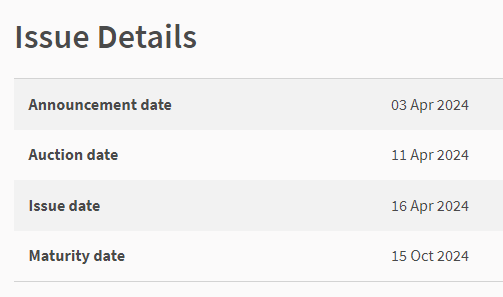

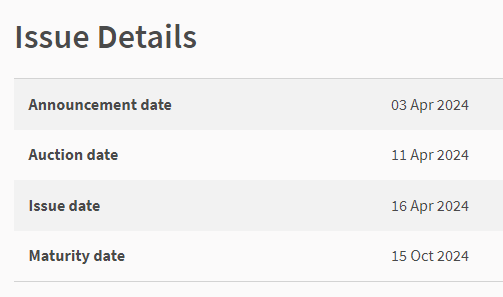

Don’t miss out on the upcoming Singapore Treasury Bill issue (BS24107N) auctioned on Thursday, 11th April 2024!

To secure your subscription, place your order via Internet banking (Cash, SRS, CPF-OA, CPF-SA) or in person (CPF) by 10th April.

For more details, visit MAS here.

If you’re new to Singapore T-bills, check out our guide on How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

The Tbill cut-off yield in the last auction was 3.80%.

Opt for a competitive bid to secure your full amount at the cut-off yield of 3.80%. Non-competitive bids may be pro-rated.

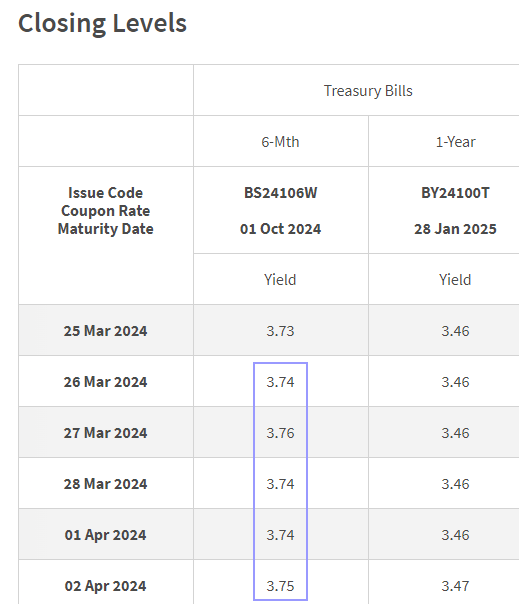

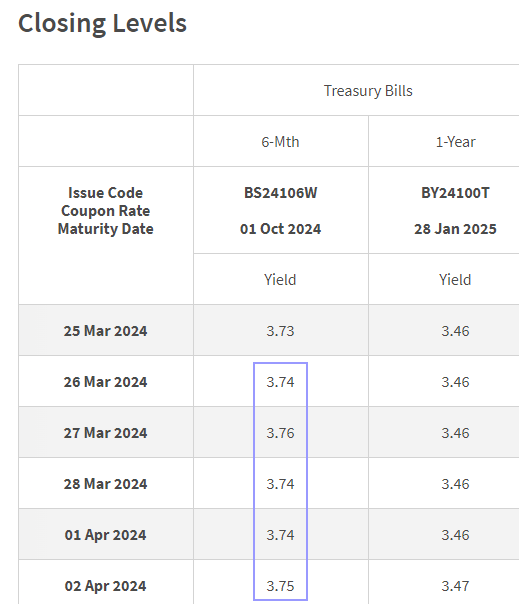

Gain insights on the upcoming T-bill yield from the daily closing yield of existing Singapore T-bills and MAS Bills.

Stay informed and make informed investment decisions. The anticipated yield for the upcoming T-bill issue is around 3.82%.

Explore Alternative Investment Options for 2023

Looking for higher return, safe, and short-term investment options in Singapore? Check out our table below for various categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y – 3Y | > $10,000 |

Leave a comment

|