Looking for a safe way to save money for uncertain times or your emergency fund?

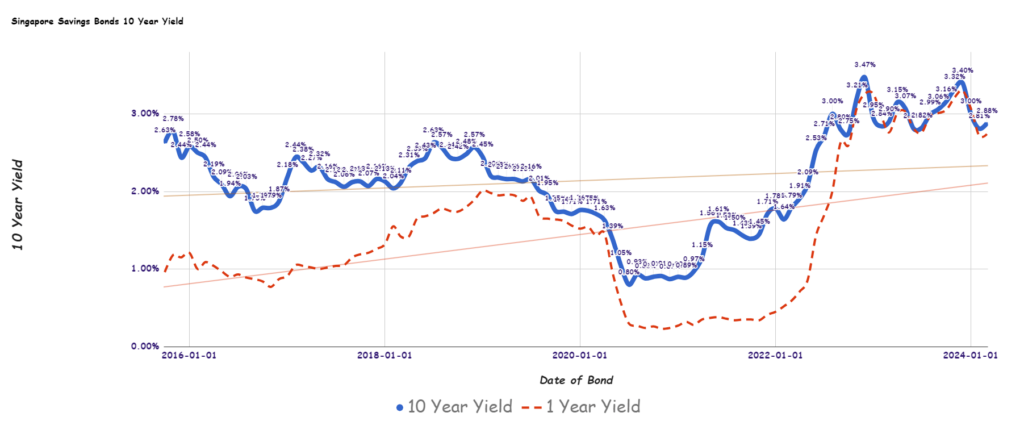

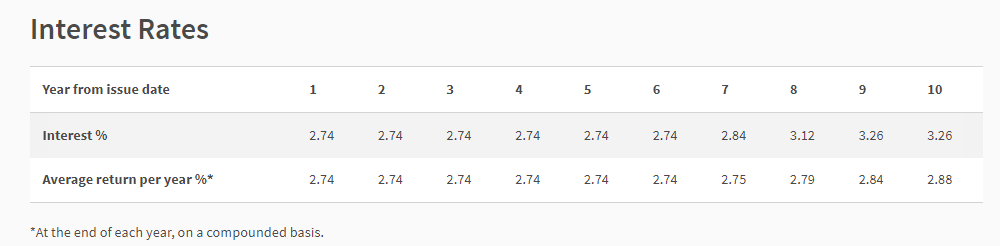

Consider the March 2024 Singapore Savings Bonds that yield an interest rate of 2.88% per year for the next ten years and 2.74% per year if held for one year with two semi-annual payments.

Your money will grow to $12,892 in 10 years and is backed by the Singapore Government. The good news is it’s available for anyone with a CDP or SRS account.

Find out more information about the SSB here.

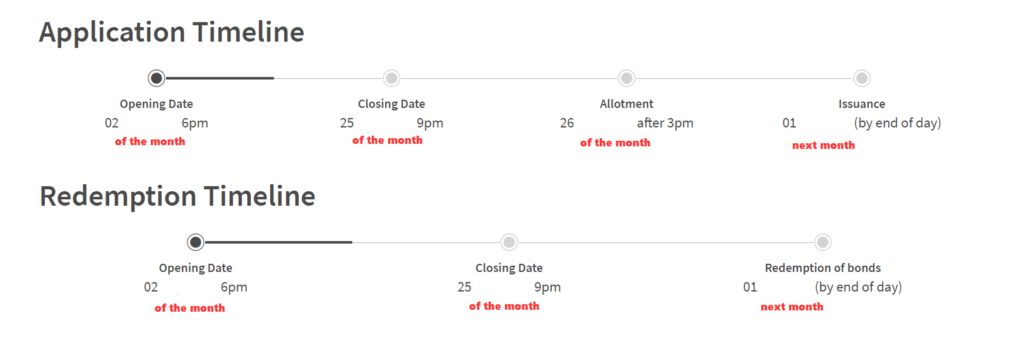

Every month, there will be a new issue you can subscribe to via ATM.

Interested? Learn about the application and redemption schedule here:

Keep in mind that the SSB allotment rate varies. In the past, the maximum allotted amount per person was lower when the interest rate was very high.

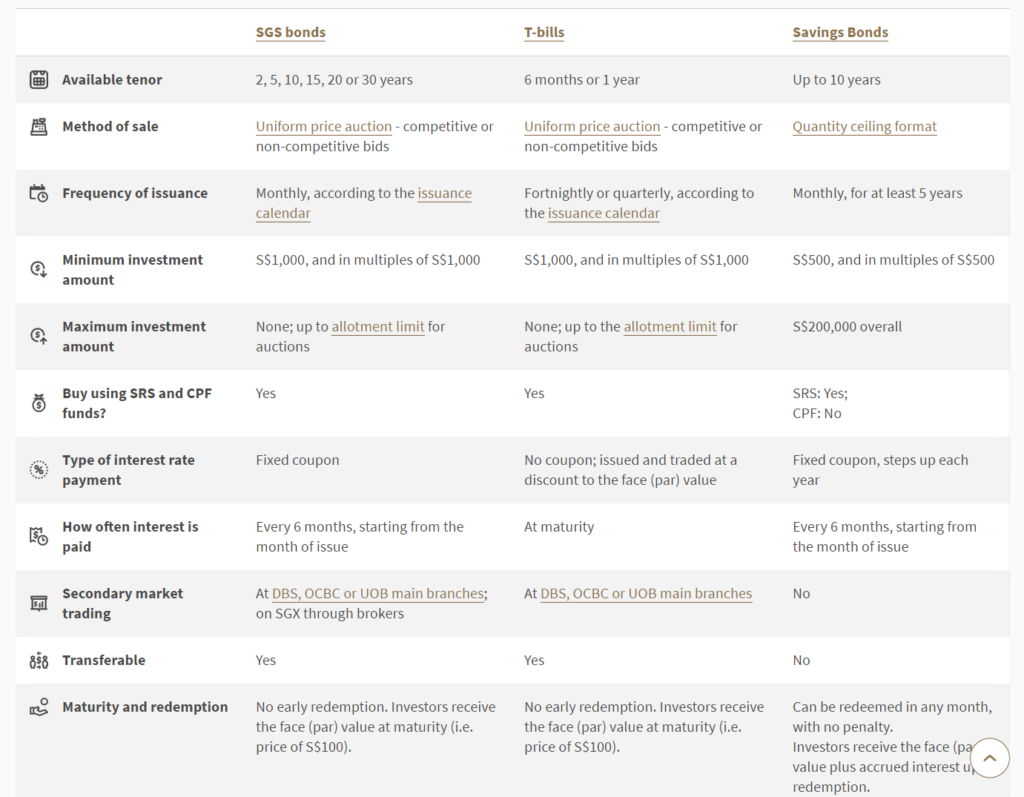

Curious to learn how SSB compares to SGS Bonds or Singapore Treasury Bills? Here’s a comparison:

If you’d like to explore other savings and investment options, check out the table below:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12-24 months | > $20,000 | Check out A good SSB Example. |

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1 month | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. More info here. |

Remember, the returns provided are not cast in stone and will fluctuate based on the current short-term interest rates.

If you’re ready to trade these stocks and start investing, consider setting up an account with Interactive Brokers for low-cost, efficient trading.

Explore more investment opportunities and stay updated with Interactive Brokers Deep Dive Series.