Are you curious about the 2023 Morningstar Investor Returns Around the World report my co-worker shared with me recently?

This report sheds light on how investors often make the mistake of investing at precisely the wrong time.

The Mind the Gap report compares investors’ returns with the fund or ETF’s performance. This particular edition focuses on international investments. If you want to explore further, you can click here to get the report by providing your details.

Here are some key points about Morningstar’s methodology:

- Morningstar (MS) bases its measurements on total returns (capital gains + dividends) reported by funds on their factsheets and websites.

- Investor returns are compared against fund returns using money-weighted returns, which factor in the impact of fund inflows and outflows on investor returns.

- These returns represent the collective returns of investors in a fund, not individual investors, making it challenging to gauge individual performance.

- Actual fund flows are not collected, but estimates are based on changes in assets under management (AUM).

- A Behavior Gap is calculated by comparing investor returns with total return averages within a group.

Overall, the data suggests that investors, as a group, fare worse than fund performance due to their timing of investments.

While it’s not fair to label individual investors as poor based on this data, it does indicate that investors often jump into funds at the wrong time, leading to subpar personal returns.

Highlighted Funds:

- iShares Global Clean Energy ETF

- abrdn Global Absolute Return

- Allianz Income & Growth

- Baillie Gifford

- JPMorgan China Pioneer

- JPMorgan Pacific Technology

- iShares Barclays Cap High Yield

- First Sentier Bridge.

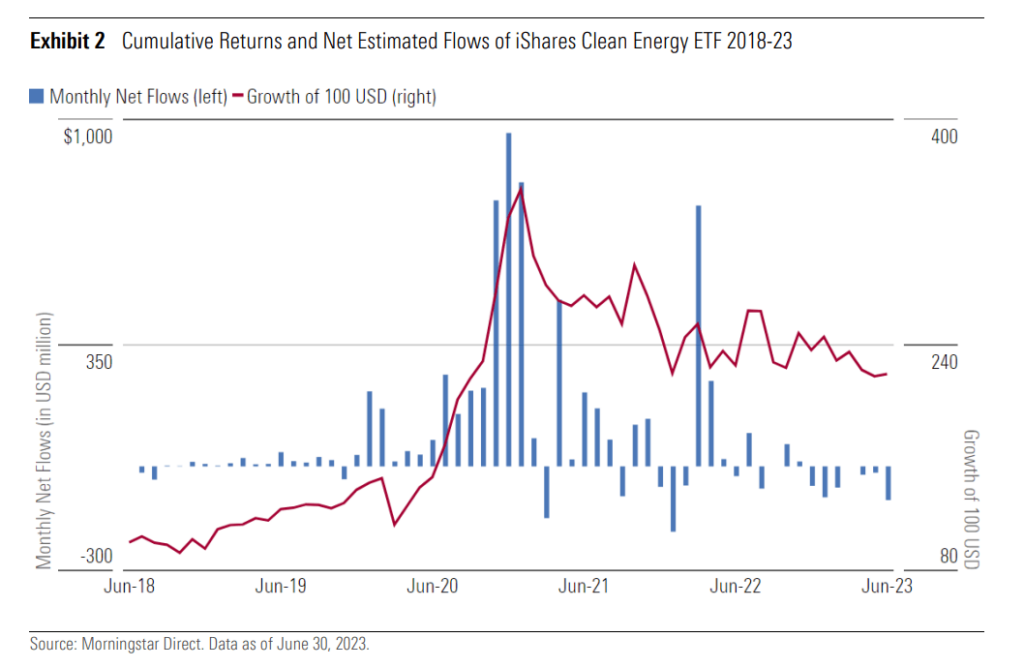

Case Study: iShares Global Clean Energy ETF (INRG)

Explore the example of the iShares Global Clean Energy ETF as a case study in mis-timing investments in the energy transition space.

Discover why investors in this ETF witnessed negative returns despite strong fund performance, showcasing the impact of poor timing on returns.

If you are interested in trading the stocks mentioned, consider creating an account with Interactive Brokers. Interactive Brokers is a trusted broker that offers low-cost trading options for various markets.